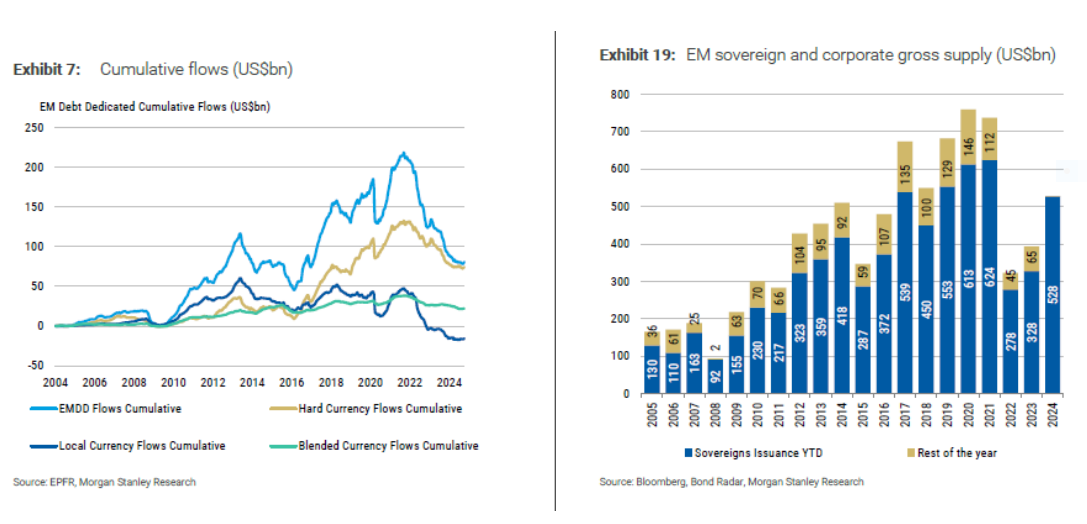

The low economic growth remains supportive for emerging market issuers, the FED is expected to continue easing its policy amid declining inflation while only a moderate new bond supply in 4Q should reduce technical pressure on the market.

Default rates are likely to stay low in 2024 and 2025, which should support low volatility in emerging markets debt corporate credit spreads, thus bolstering appetite for carry in this asset class…

A favourable macro backdrop for Emerging Market Debt